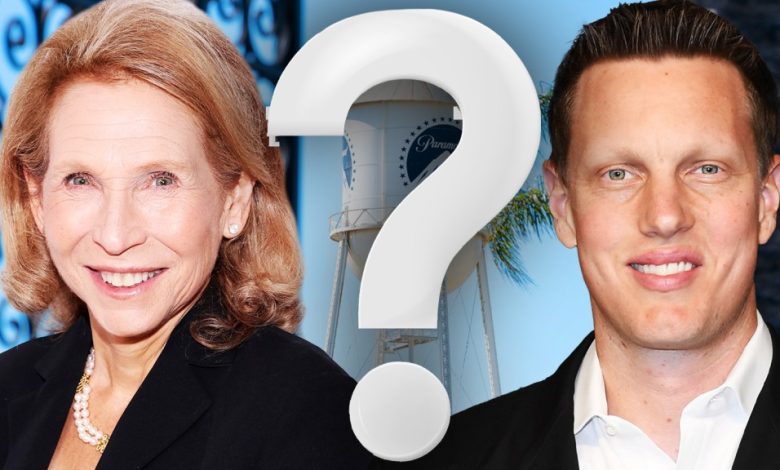

Paramount-Skydance Merger in Jeopardy Amid Trump Lawsuit and FCC Delays

A once-promising merger between Paramount Global and Skydance Media is now facing uncertainty, as legal complications and regulatory delays cast a long shadow over the deal’s future. The Federal Communications Commission (FCC) has yet to approve the transaction, and former President Donald Trump’s high-profile lawsuit against CBS—a Paramount-owned network—has only heightened concerns.

According to analyst Rich Greenfield of LightShed Partners, the merger could collapse if not finalized by July 7, which marks the end of another 90-day automatic extension. If the deal doesn’t close by then, Greenfield believes both parties may walk away. Notably, the $400 million breakup fee wouldn’t apply in this case, since FCC approval was a prerequisite for closing.

Trump’s $20 Billion Lawsuit Fuels Tensions

The legal pressure stems from Trump’s $20 billion lawsuit against CBS over its editing of an interview with then–vice presidential candidate Kamala Harris. Mediation efforts have stalled, and there’s growing political scrutiny around any potential settlement. Several lawmakers—including Senators Elizabeth Warren, Bernie Sanders, and Ron Wyden—have cautioned that settling the lawsuit could be seen as a form of bribery, especially as the company awaits FCC approval.

Adding to the scrutiny, California state senators have launched investigations to determine if Paramount’s actions may violate state bribery and unfair competition laws. Meanwhile, the nonprofit Freedom of the Press Foundation has pledged to sue Paramount should it settle, warning that such a move could threaten First Amendment protections and set a dangerous precedent for other media outlets.

Paramount’s Leadership in Legal Crosshairs

Greenfield emphasized that Paramount’s board and executives are deeply concerned about personal liability if they authorize a settlement with Trump. The recent addition of Mary Boies—a veteran litigator and wife of famed attorney David Boies—to the board underscores the legal weight of the situation.

Despite these roadblocks, investor hopes have remained cautiously optimistic due to Skydance CEO David Ellison’s backing by his father, Oracle co-founder Larry Ellison, who is known to have a close relationship with Donald Trump. This connection has fueled belief that the deal could still close, especially as Paramount remains a major player in global entertainment.

However, with the annual shareholder meeting set for early July and no FCC approval in sight, time is running out.

See More ...

Financial Pressures Mount

Paramount’s parent company, National Amusements Inc. (NAI), controlled by Shari Redstone, has been under financial strain for years. Merchant bank BDT Capital Partners and the Ellison family have reportedly lent $400 million to help NAI manage its debt. The precise repayment terms remain unclear, but if the merger fails, it could create a serious financial setback for Redstone’s holdings.

While NAI still owns valuable assets such as Paramount shares and land around its theater properties, the company’s long-term stability may depend on the merger going through.

Uncertain Path Ahead

Insiders say that although there is widespread support for David Ellison’s vision, delays are eroding confidence. “We all want David in there,” one source stated, “but the longer it takes for him to get in there and make changes, it’s not good for either company.”

As the clock ticks down, all eyes are on the FCC—and the courtroom—to determine the fate of one of Hollywood’s most talked-about deals.